VAT Invoices

Value Added Tax for EU based and other clients

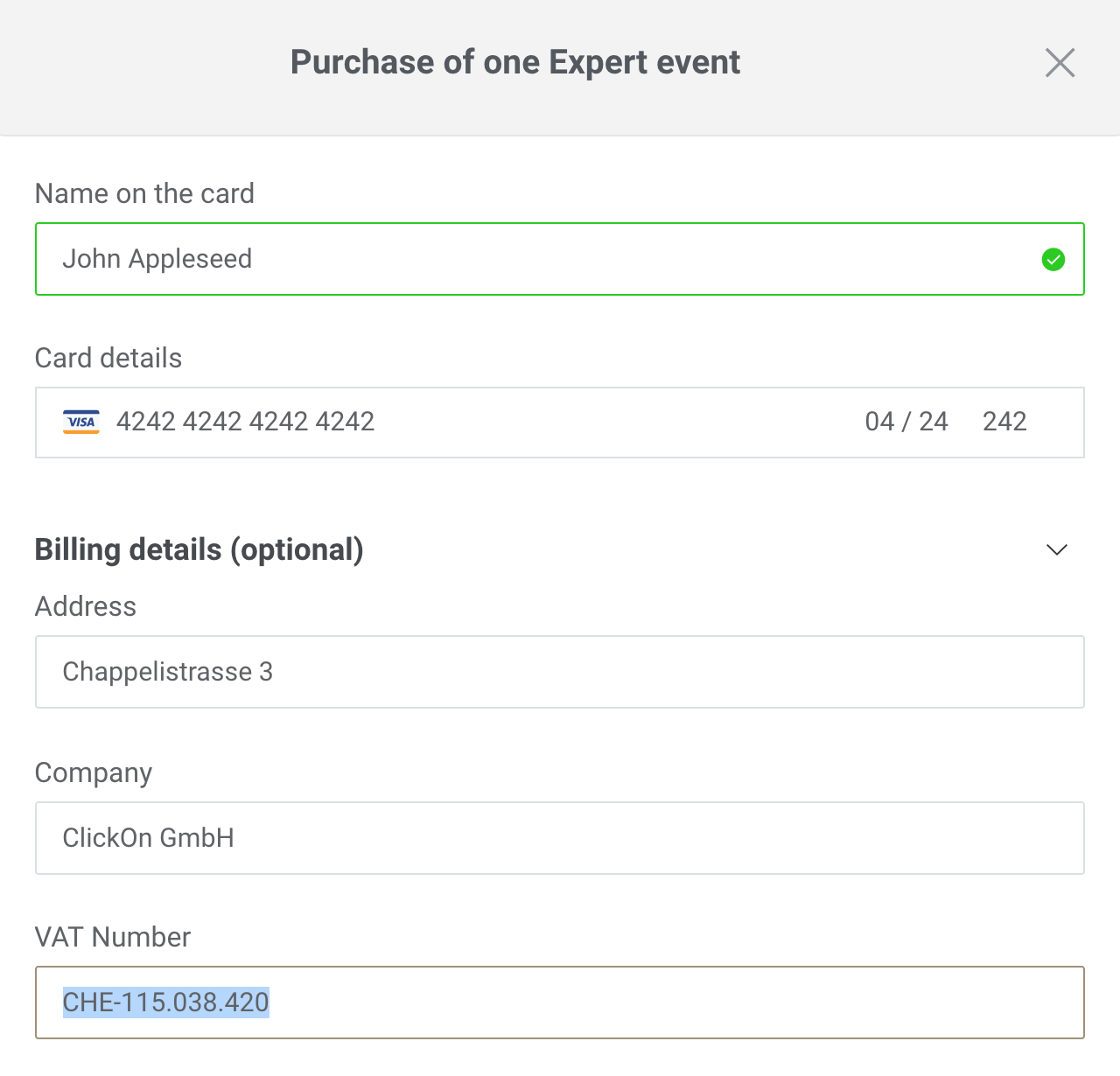

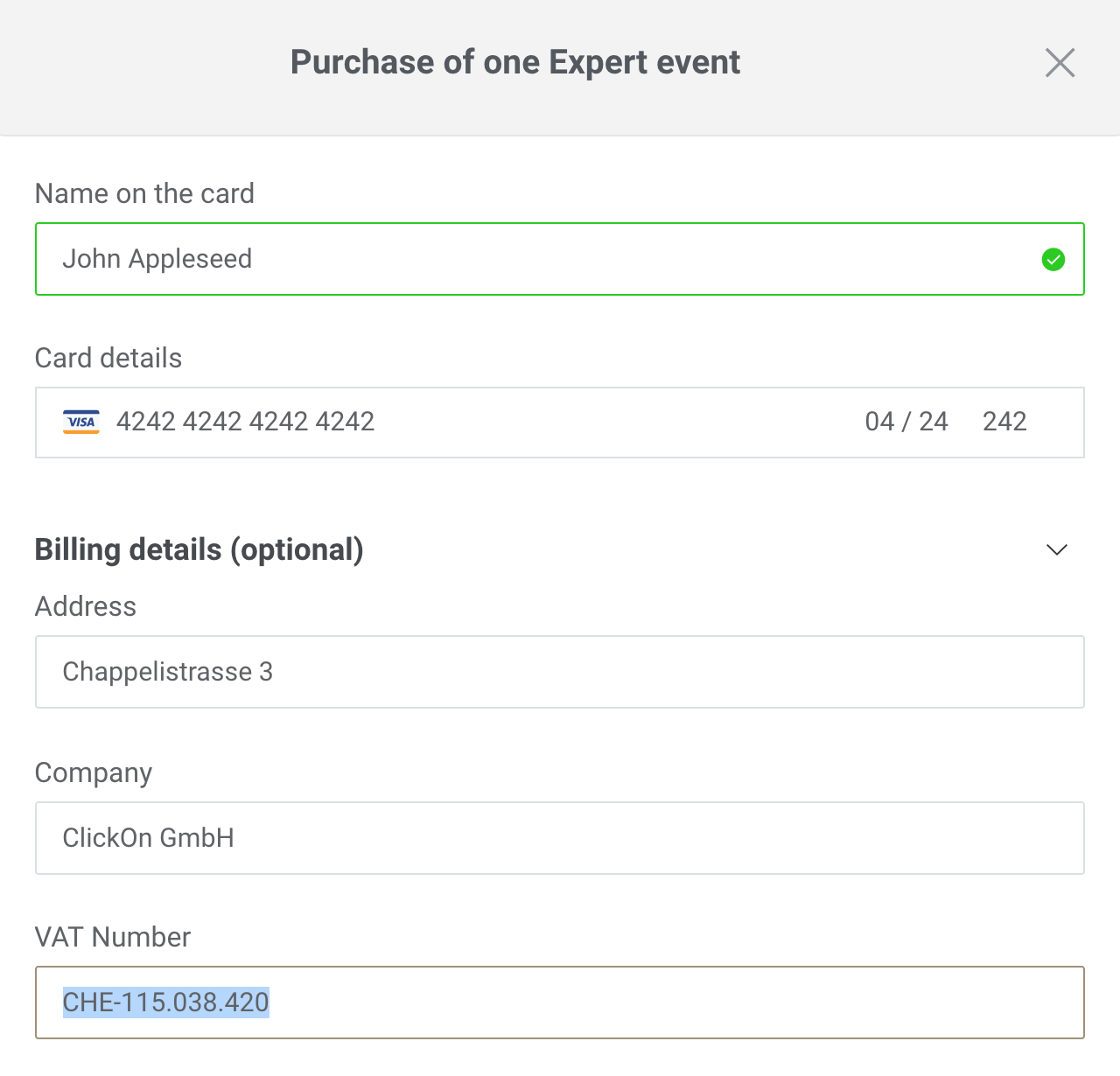

Clients registered as a business in the EU must fill in their Value Added Tax (VAT) number during the purchase. See below how you can do it:

To comply with EU tax regulations, we are obliged to charge clients with their billing country's VAT rate if no such number is added.

In case you forgot to including your VAT number, you can do that later over our support Chat. We will also issue a new invoice to you.

If you are a Swiss company, you are also required to include the VAT number in the payment form. We will be charging VAT (7.7% Mehrwertsteuer) on top of the listed price, you will be able to claim it back from the tax authorities.

We reserve the right to charge VAT directly to your credit card in file in case VAT charge is applicable. The tax charge may be executed later and not during the corresponding purchase operation.